Anyone who has a mortgage should know about a certain category of functions — piecewise exponential functions. The balance of your mortgage grows exponentially (albeit with a very small growth constant) and then you make a payment and the balance drops to some new level whereupon it begins growing exponentially again (until next month). Question: what if your payment was only large enough to take care of the interest that accumulated in the previous month? Answer: you are going to be paying that bill to the day you die…

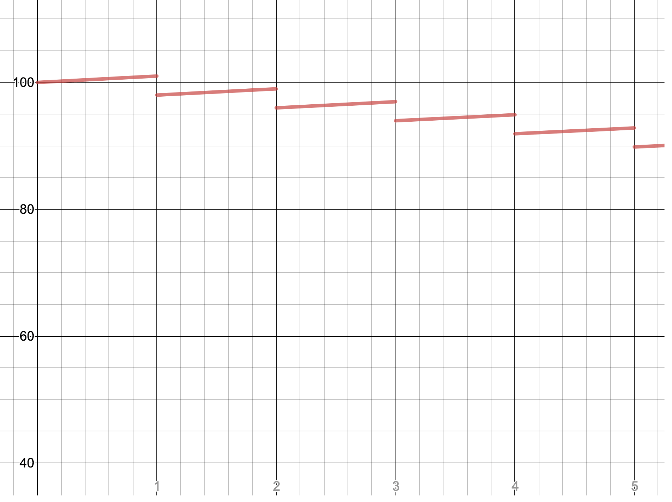

This is the graph of the balance remaining (over the first few months) on a fictional mortgage of $100k at an interest rate of about 12%. That’s an exorbitant interest rate by today’s standards but it serves better to illustrate the type of function we’re looking at: exponential growth over a period of time followed by a sharp reduction (that’s you making your monthly payment) followed by more growth followed by another payment, et cetera.

A company’s net worth is modeled by a similar class of functions. As the owners and the employees toil away at whatever they’re doing, they are producing value. The company’s net worth increases. This is a good thing – companies that are able to grow do good things for society; they create new products and services, they create jobs, maybe they give raises to their employees.

Then comes the quarterly tax payment…

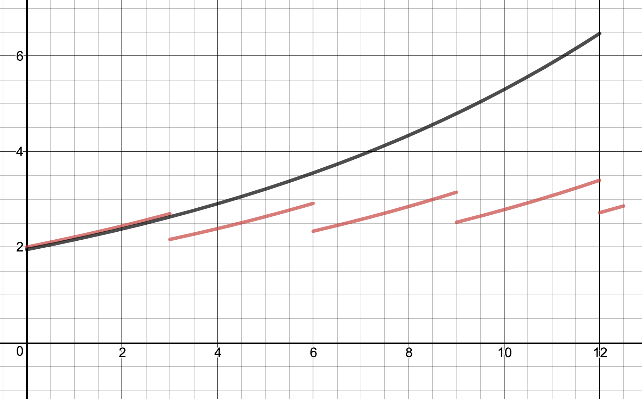

The graph shows two scenarios for the growth of a company’s value. In black, is growth with no taxation and in red we see the effect when a quarterly tax payment is added. (Both the rate of growth and the size of the tax burden have been exaggerated to help illustrate the issue.)

So-called “trickle down” economics has justifiably been derided as being “voodoo” — not based on facts, but rather on wishful thinking. Reducing the tax burden on wealthy individuals is, most likely, only of benefit to those individuals. This is human nature; people like to hold on to what is theirs, not let it trickle down to anyone else!

But, if we look at small business and corporate taxation through this lens the results are rather different. Reducing taxation for businesses unleashes the power of exponential growth. On the other hand, increasing taxation can actually lead to complete stagnation. What matters to society is what a business does with the added valuta they can accrue if their tax bills are cut. If all the money goes to shareholders and corporate officers then this wasn’t smart fiscal policy. If most of the money goes to adding jobs and pay increases for the workers, then it was.

So here’s a modest proposal: cut a business’s tax bill when their U.S. payroll (exclusive of executives and bonuses) has gone up. That’s it. If they add a plant in Tajikistan, that’s nice; the folks there can probably use the work — that just shouldn’t have anything to do with U.S. taxes. If they want to give the CEO a 320 million dollar bonus, awesome! I’m sure he or she did something that was equivalent to the full-time efforts of 10,000 average Americans. But, I can’t see how a company that’s willing to sink such huge amounts into executive perks can claim to be overburdened by our taxes…

President Trump is making plans for an across-the-board corporate tax break. It seems likely that most of the extra money generated by such a move will end up in the hands of relatively few Americans. They will certainly trickle some of it down on the rest of us, but mainly they will just amass huge personal fortunes. If, instead, the corporate tax cuts were tied to being good citizens (in exactly the sense that President Trump has lauded — the creation of jobs for Americans), I think the results would be better.

At this moment in time, the U.S. National debt has reached such a staggering level that it actually exceeds our annual GDP. Imagine how you’d feel about your personal finances if you had nothing in the bank and you had credit card debt that totaled to more than you earn in a year! This is really and truly not the time to be raising expenditures or cutting income. Nevertheless, cutting taxes for the corporations that are doing the right thing by our society can help them to access the power of exponential growth. That amounts to a lot more than a “trickle”!